Partnership with Lukka

Lukka is the leading crypto asset software and data provider and the institutional source for pricing and valuation. Lukka’s software and data solutions turn complex blockchain and crypto asset data into easy-to-use information so that businesses can support traditional middle and back-office operations.

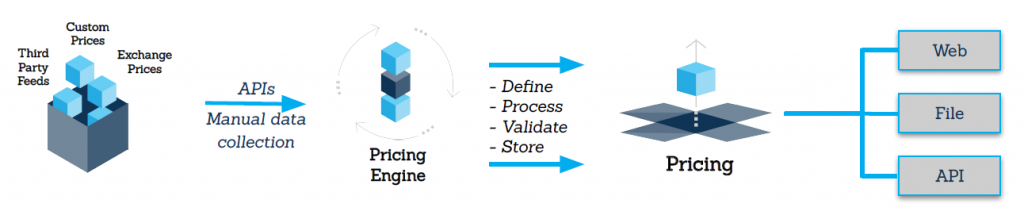

dxFeed is Lukka’s technology vendor and data distributor of reference data and asset pricing products. Lukka Reference Data and Lukka Prime are now available via the full scope of dxFeed data services in real-time and historical access modes.

Lukka Prime Data

Lukka Prime is the world’s first Fair-Market-Value pricing methodology for crypto assets. It is specifically designed to meet the needs of businesses that require post-trade crypto asset pricing and aligns to GAAP, IFRS, and SEC guidance for accounting and valuation standards.

- Lukka Prime Intraday

Gives a near real-time gauge of the market by delivering minute-by-minute asset pricing on a 60 second delay. - Lukka Prime Hourly

Allows for more data capture of minute-by-minute asset prices by reporting on a 60 minute delay. - Lukka Prime End of Day

Ensures maximum accuracy and data capture of minute-by-minute asset pricing by capturing a full day’s trading activity before reporting (T+1 available at 3:30am EST).

Key Differentiators

- Aligns to new SEC Valuation Framework rules

- A well-defined and transparent methodology (White Paper)

- Built and maintained in a SOC Type 2 environment

- Qualitative and quantitative factors used to determine the primary market (including region, KYC process, liquidity, etc.) at each time interval

- Prices based on executed trade data and verifiable at any given time

- Historical pricing coverage starting in 2014

- Transparency to all underlying data

- Industry standard for tax, NAV calculations, etc.

- Manual and automated data quality checks are used to verify final prices

Lukka Reference data

Lukka provides validated crypto master data and mappings to support trading, operations, finance, and audit functions.

Comprehensive

Coverage of thousands of tokenized assets (and derivatives) from 100+ sources (10+ DEX’s) & descriptive data for actively traded crypto assets. New assets are added daily.

Standardized & Normalized

Cleaned, validated, maped, & enriched data for business use and constant monitoring is in place for incremental data changes, or corporate actions.

Institutional Delivery

Lukka Reference Data is available via web and flat files, and institutional-grade API.

Benefits:

- Continuous monitoring of the crypto asset ecosystem for new assets, ticker changes, and crypto corporate actions (such as forks and airdrops)

- Standardization of inconsistent ticker symbols and naming conventions and unique identifier (Lukka ID) assignment for every asset

- Tracks historical changes and maintains accurate mappings

Coverage:

- Tracks, normalizes, and maps data across 100+ entities, including 10+ Decentralized Exchanges (DEX’s)

- Coverage of 6000+ crypto assets and 27,000+ crypto asset derivatives (increases every day)

- Coverage of 27,000+ trading pairs across the ecosystem

Quality:

- Built and maintained in a SOC Type 2 environment

- Information integrated directly from primary sources, including exchanges, pricing providers, and white papers

- Automating and manual processes to capture, research, and resolve discrepancies with an audit trail

Timeliness:

- Continuous automated monitoring via API for data changes

- Daily updates of exchange and pricing provider data