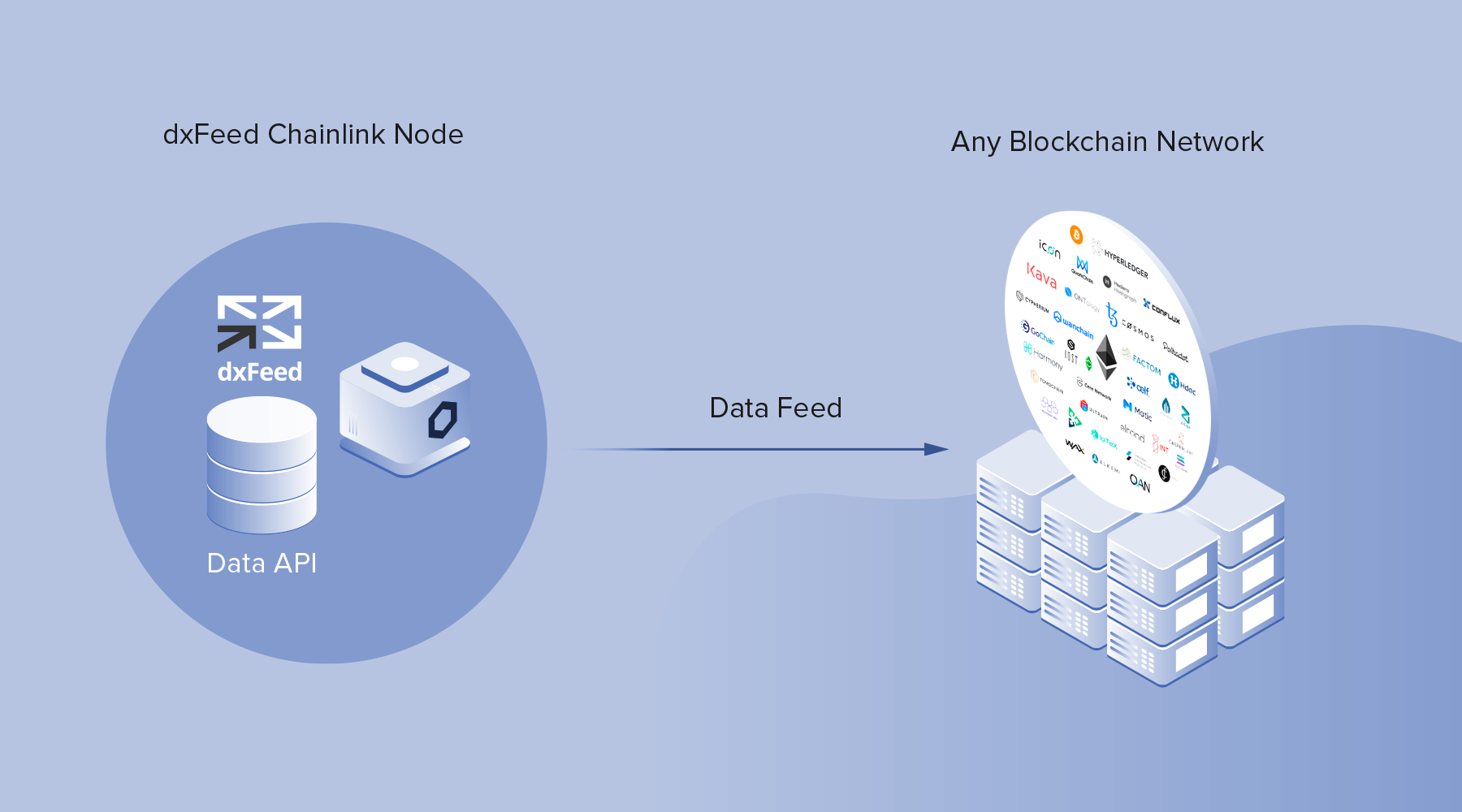

dxFeed has successfully expanded the on-chain datasets available to smart contracts through the official Chainlink node. Developers can now call the dxFeed Chainlink node to access premium options analytics data, including implied volatilities (IV) for options markets, along with real-time pricing data for a wide range of equities and cryptocurrencies. We have worked extensively with the Chainlink Labs team to refine the calculation methodology of our IV data so it’s enterprise-grade for pricing cryptocurrency derivatives markets.

Our advanced analytics data service gives DeFi developers access to at-the-money and VIX-esque implied volatilities for BTC and ETH. It also applies a model-free algorithm that works well on both low and high liquidity markets as well as in cases of high volatility. This algorithm generates prices that fit the market, arbitrage-free prices across an option class, and smooth price and volatility curves.

Since implied volatility data has traditionally been absent from blockchain-based markets, smart contract developers now have the opportunity to build new types of smart contract applications like decentralized options protocols, volatility-based rebasing tokens, synthetic assets for volatility exposure, or even advanced on-chain trading strategies. As DeFi markets evolve, we plan to further expand our options analytics and volatility data to include additional cryptocurrencies.

Developers interested in accessing our implied volatility data within their smart contracts can learn how to do so through this documentation.

As a cloud-based data solutions provider, dxFeed offers a comprehensive list of global, real-time, and historical market data that powers over 2.5M financial instruments for industry-leading financial institutions. With a 99.9% uptime track record and the most advanced compression, storage, extraction, and streaming protocol mechanisms in the industry—our data and data services are highly reliable and widely used.

We selected Chainlink to bridge our API data into DeFi markets because it’s the industry standard oracle solution and time-tested in production across leading blockchain applications worth tens of billions of dollars. Through our Chainlink node, we can access a growing pool of smart contract developers and emerging DeFi applications, expanding the reach of our data with little integration work. The result is developers having highly refined and cryptographically secure financial market data at their fingertips when architecting a new decentralized and open global financial system.

“We’re excited to see data providers such as dxFeed successfully diversify their revenue streams and continue to introduce new datasets on-chain through the Chainlink Network,” stated Daniel Kochis, Head of Partnerships at Chainlink Labs. “With smart contract developers eager to build decentralized applications around new high-quality and tamper-proof data, we are committed to supporting new and established data providers in selling their API data on-chain by providing a seamless integration process.”

P.S.

Following this launch, we want to take some time to explain the importance of this moment and place it in the broader context of where Fintech specifically, and finance in general, appear to be heading. Please look at the article ‘Traditional Financial Data, Coming to a Blockchain Near You.’

About Chainlink

Chainlink is the industry standard oracle network for powering hybrid smart contracts. Chainlink Decentralized Oracle Networks provide developers with the largest collection of high-quality data sources and secure off-chain computations to expand the capabilities of smart contracts on any blockchain. Managed by a global, decentralized community, Chainlink currently secures billions of dollars in value for smart contracts across decentralized finance (DeFi), insurance, gaming, and other major industries.

Chainlink is trusted by hundreds of organizations, from global enterprises to projects at the forefront of the blockchain economy, to deliver definitive truth via secure, reliable oracle networks. To learn more about Chainlink, visit chain.link, subscribe to the Chainlink newsletter, and follow @chainlink on Twitter. To understand the full vision of the Chainlink Network, read the Chainlink 2.0 whitepaper