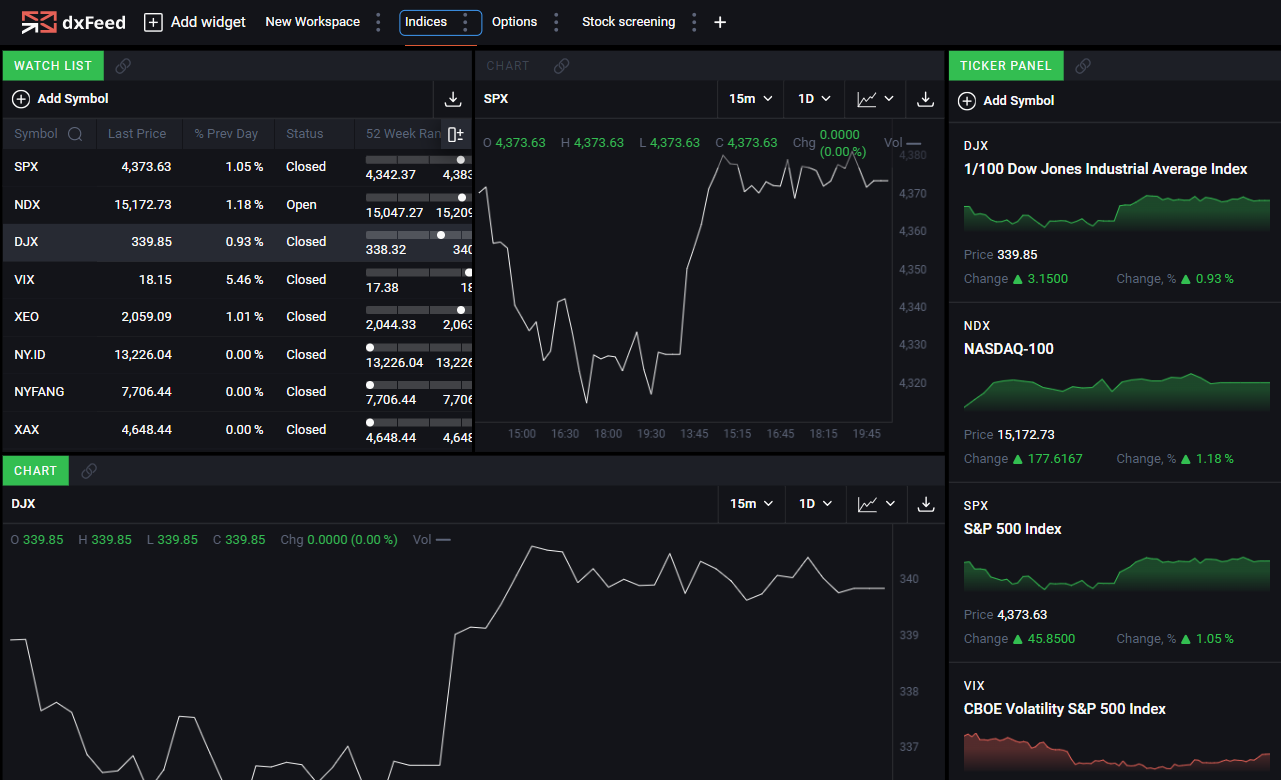

Inforider

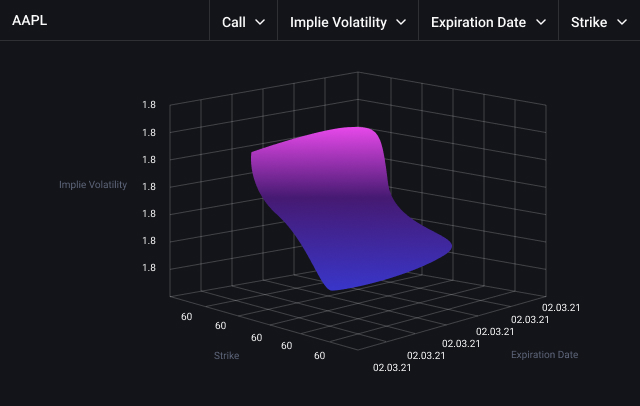

The Inforider terminal offers a dynamic solution for trading analytics and research, featuring pricing data, worldwide financial news and insightful commentary, a comprehensive array of fundamental data, estimates, corporate actions, and events, as well as advanced visual analysis and charting tools. Our groundbreaking feature, powered by dxFeed onDemand cloud technology, allows you to effortlessly rewind time and instantly replay the entire market at the tick-level, starting from any chosen moment.